SIMPLE CFO ROAD MAP

KICK OFF

On-boarding Call

Congratulations on your first step to FINANCIAL FREEDOM!

Assess Your Team & Your Books

CFO & Owner Goal Planning

Meet Your CFO Partner

ASSESSMENT

Create Your CFO Dashboard

CFO & Owner

Set Standards

Other SimpleCFO Tools

IMPLEMENTATION

Open Bank Accounts

(Income, OpEx, Owner’s Comp,

Taxes & more)

Expense Analysis

(Cut, Negotiate)

Owner’s Analysis

(Pay yourself for your hard work)

CONTROL

You Control

Your Cash

Know

What You Make, Spend& Keep!

Control

Your Spending to KEEP MORE!

GAME PLAN

Establish & Review

Current & Target

Allocations

Implement

Allocation Schedule

& Roll-out Plan

Continuous Evaluation

& Improvement

Financial Clarity and Profit First Implementation

We start with the Progress Sheet where we monitor every step of relationship :

Note at the end we are putting KPIs at the forefront to measure: the drop downs are Not Started, IN Progress, and Complete

Accountability KPI Sheet

This sheet tracks the KPIs for accountability and includes the overall goal, the next steps to get there, who is responsible, due dates and the notes are for any obstacles.

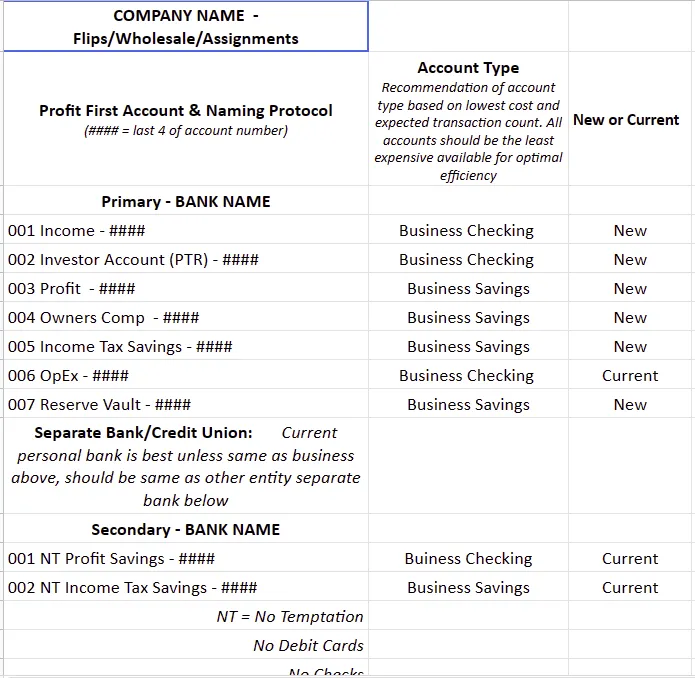

Bank Account Tracking Sheet

This sheet is where we track bank accounts and which entity and just overall Profit First implementation items.

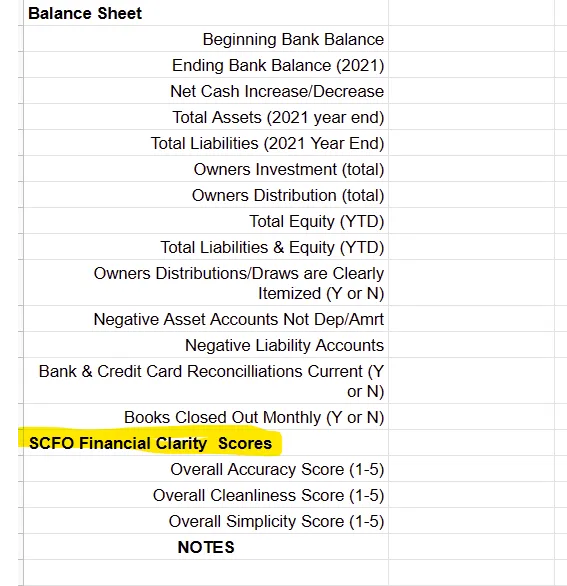

Financial Clarity Assessment Sheet

This sheet is for the Financial Clarity Assessment: This allows us to get a high level analysis of the books and what their financial story is: what is going okay and where the focus needs to be. This also helps us evaluate their bookkeeping team, where they were vs where they want to be. Finding the GAP. The GAP is finding where they are and where they want to be (helps to measure KPIs to get there). I highlighted the SCFO Financial Clarity Score because that is key to our assessment.

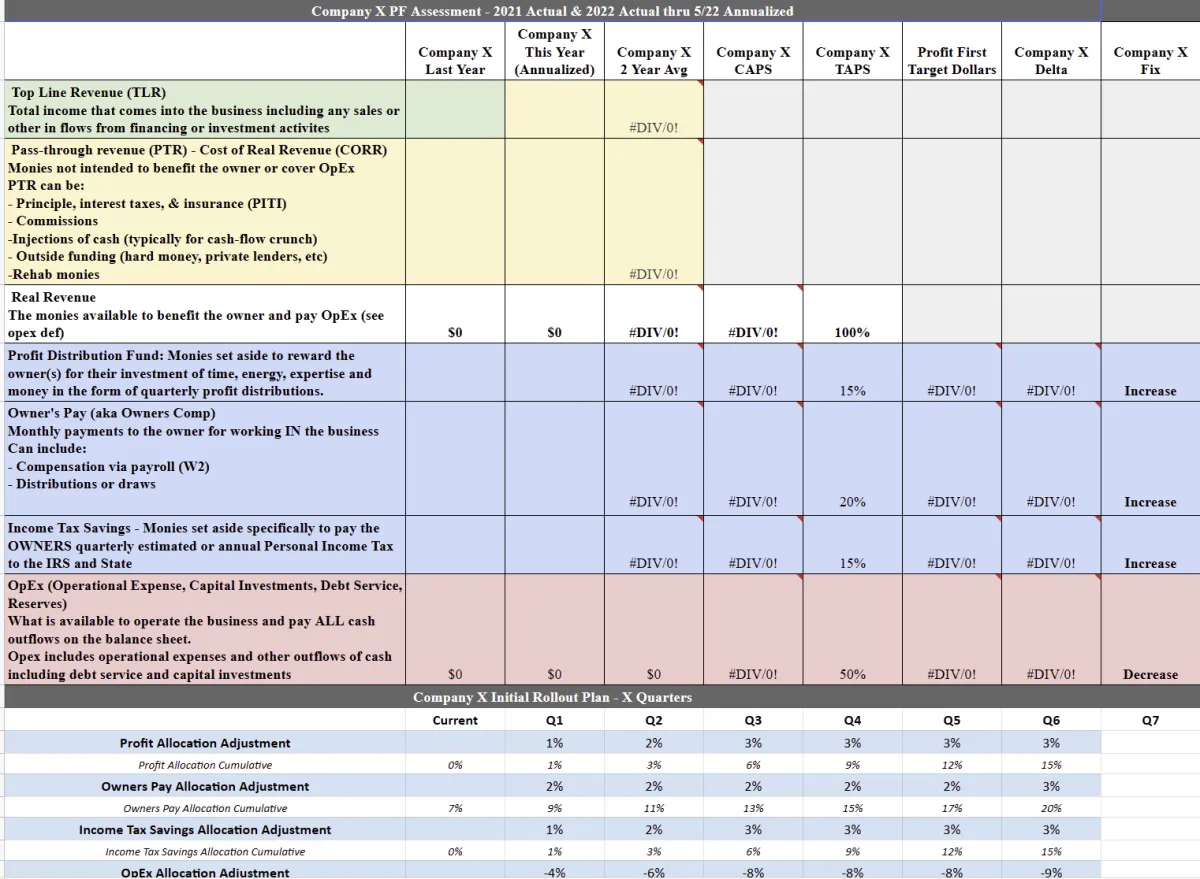

Initial PFARP – Profit First Analysis and Roll-out Plan

This is the Initial PFARP – Profit First Analysis and Roll-out Plan. We do this every quarter or more often if necessary. This tells us how they are spending money and where they NEED/WANT to spend money. We explain this in detail as part of the full Profit First Implementation. It is a big eye opener on how they are spending money and where they want to be. The roll-out plan at the bottom is the baby steps to get them to the goal.

Flip & Rental Allocation Calculator

This is the allocation calculator. We have one for flips and one for rentals. Plug the bank in and the allocations are done for you!

PF Allocation Calculator to Cash Position Calculator

At the bottom of the PF Allocation Calculator, we have a rehab expense calculator and cash flow analysis: The purpose is to track cash available to complete draws/other methods of financing. Very comprehensive for planning. Clients love this feature.